The India Playbook: Navigate India with the 'Category of One' mindset

India contains multitudes and demands a fit-to-context playbook. I explore ten insights over ten emails. Part X: Navigate India with the 'Category of One' mindset

Performonks shares ideas to inspire marketers to become more masterful at growing brands and navigating careers. If you haven’t subscribed, join 3,541 readers by clicking here.

Check out my new website here.

This is the last of a ten-part series on India. Each mail decodes one aspect of the Indian market for businesses that wish to win and scale here.

Part X: Navigate India with the 'Category of One' mindset

“Competition is for losers”

-Peter Thiel, Source

Maybe idealistic. Maybe naive. But, I believe that a business needs to operate with the ‘category of one’ mindset to win and scale.

The last nine editions have established a shared understanding of the Indian market structure. This edition builds on that understanding - I landscape consumer-facing brands that follow a ‘category of one’ mindset.

Grab your cutting chai and dive in.

If you missed them, reading the previous editions will help (especially this, this, and this) before you read ahead. I’ll wait.

Done? Let’s start.

Two broad principles to keep in mind about the peculiarity of India:-

1) There are three main consuming segments

In descending order of per capita consumption -

The top 1%. Let’s call them Super Rich. They travel the world, have international tastes, and experiment with lifestyles and products.

The next 19%. Let’s call them India. English and vernacular speakers, upwardly mobile, they accommodate their aspiration to consume more within their cash flow constraints.

And the next 40%. Let‘s call them Bharat. Vernacular speakers, cash-strapped, underexposed, prefer sachets and magic price points of 1/5/10, make frequent offline shopping trips.

2) India lags in the number of users, usage, and value metrics

India is a large consumer market in aggregate but lags behind the West and even China in all growth metrics.

Users - the number of users of a category.

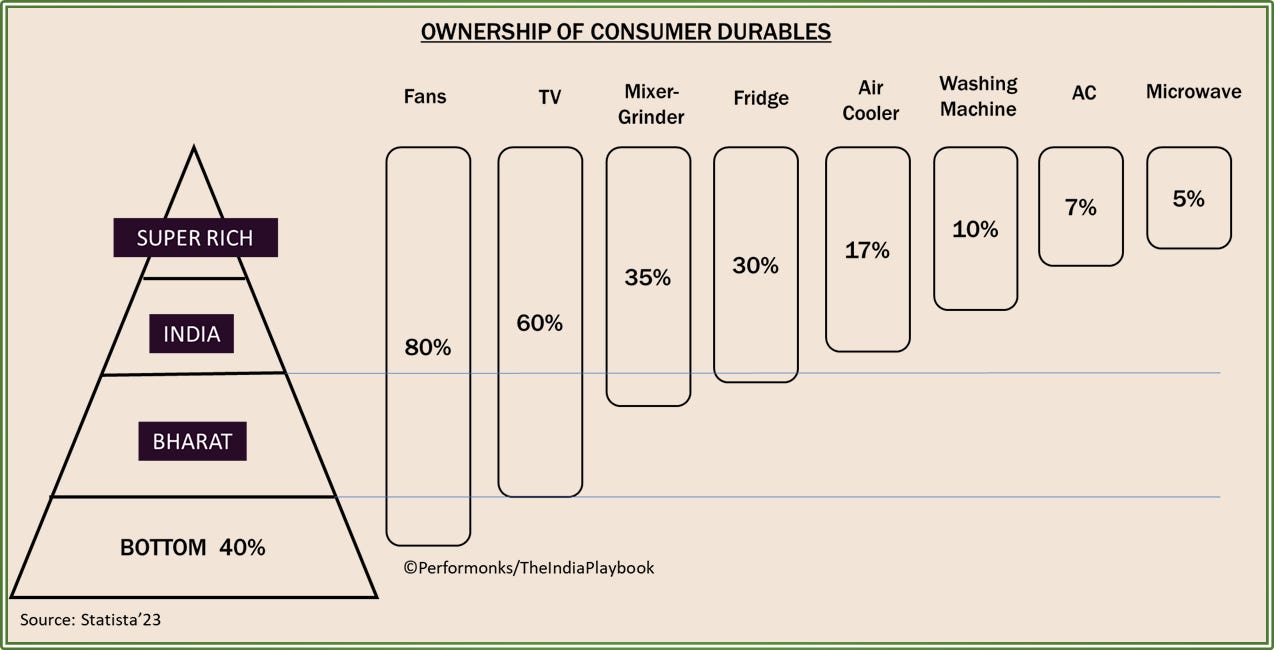

Take a look at the penetration of consumer durables. Even a basic category like fans is absent in 20% of homes.

Usage - the number of products we consume

Japanese women use up to 8 to 12 products for their skincare routine. The average Indian woman uses 2.

Value - the quantity we consume and the prices we’re willing to pay

India’s per capita spending on beauty and personal care business is $12 (this is where China was in 2006-07). US, Europe, and Southeast Asia spend in the range of ~$30-35. (Source).

Even consumer tech revenue lags other markets. In this tweet, Kunal Shah compared Meta’s monthly active users (MAU) from India versus the revenue generated.

Meta had 410 million MAUs in India versus 231 in the US, but India generated only $1.8 billion (₹15,000 crore) revenue, against the USA’s $40.7 billion (3.4 lakh crore).

Why does all this matter?

This matters because our obsession with speed-to-scale is creating a marketplace of sameness

We like to worship at temples of large idols. Even the statues we’ve been building lately are (literally) larger than life - the Statue of Unity of Sardar Vallbhbhai Patel stands at a grand 182, the world’s tallest.

In our scale-obsessed culture, ‘small’ feels like a failure at worst and a ‘lifestyle’ business at best. We are running a race of unicorn proportions - India produced 43 unicorns in 2022 and 111 in 2023. In the decades before, there were only 8.

Most D2C and consumer tech startups target the ‘SuperRich’ or ‘India’ segment because it’s relatively easier to scale to 50cr-100cr ($6MM-$12MM) through performance marketing and social ads for this audience.

Then to scale further, startups either target the Indian Diaspora (e.g. Vadham is going global), or add offline distribution (e.g. Mama Earth went omnichannel pre-IPO to bolster revenues).

But they don’t venture into ‘Bharat’ because they know that to win there requires a complete rework of the product-market fit.

This has led to an overcrowding of the creamy layer. Products jostle with each other on physical shelves and end up looking the same on virtual shelves (there are over 5,000 results for Vitamin C Face Serum on Amazon at the time of writing this).

This entire model is based on a mindset of a ‘finite’ game. A game that ends at valuation and exit.

But there’s a different game that can be played - an infinite game that builds legacy and enduring businesses. Nestle entered India in 1961. Unilever, even earlier, in 1931. These companies have taken multiple decades to build four-figure brands that serve all Indians.

To play an infinite game, we need a different mindset.

Why a ‘category of one’ mindset is the answer

James Carse, a New York University Professor Emeritus of religion and history, wrote Finite and Infinite Games. He said that known players, fixed rules, and firm objectives define finite games. Becoming ‘better than’ the competition and getting the highest valuation fastest is the hallmark of a finite game.

On the other hand, infinite games are those in which our objective is not to win in the short term but to keep playing and winning over the long term. To win in the long term, a business evolves with the market and consumer situation.

When we define success as ‘beating competition,’ we are compelled to compete against them, and we start apeing their playbooks. We start matching the competition’s strategies—the same consumer offers, similar benefit propositions, the same keywords, and performance marketing.

This soon becomes a race to the bottom. In the end, tactics like logistics partners, retailer margins, and shelf space are equalizers for all brands. The only way to win in any of these is to spend more. Soon enough, the price of ambitious growth becomes unaffordable.

I am not saying that revenue growth is not important. It is. What I am saying is that long-term sustained revenue growth is even more important. And that this long-term sustained revenue growth comes from playing a game that only you are uniquely equipped to play.

What if, instead of living quarter to quarter, we think of revenue targets as a series of finite games (or goals) within the larger infinite game (and goal) of serving consumers uniquely and earning trust with consumers and the ecosystem?

For consumer brands, this means building a category of one.

Being unique enough that consumers remember.

Being useful enough that consumers buy again.

Building a business model and ecosystem that becomes self-sustaining.

Many brands are playing in a category of one.

I have attempted a framework to map these brands for their segment.

A WIP landscape of ‘category of one’ brands

At a very, very high level, there are four main growth strategies for any market. In a market like India, with three diverse consuming segments, they will play out differently for each.

Look at this framework of D2C and consumer tech startups, mapped to the growth strategy and the consumer segment.

Strategies and examples could be.

Unlock access to better products & benefits:

upgrade to higher price points by offering better benefits or lifestyle - organic for India, artisanal bread for SuperRich, sugar-free chyawanprash for Bharat

add a product to an existing regimen - conditioner for Bharat, Vitamin C serum for India, night retinol oil for Super Rich

upgrade from unorganized to organized: loose staples to packaged staples for Bharat and India, jewellery for India and SuperRich, agarbatti for SuperRich

Bundle products & services in new ways: bundling services and products open up new market spaces and upgrade consumption. Urban Company and Lenskart bundle a service and product to offer convenience and meet a need.

Serve an underserved user base with specific benefits: products and services for consumers with special needs, such as seniors and pet parents.

Build a community and then serve and monetize it: I think this might be the business model of the future. Cred is building a community of SuperRich, while Parentune is a community of parents and experts supporting each other through the toughest job on earth.

Thanks for reading. I would love your feedback and builds on this thought process!

What’s next for The India Playbook?

The India Playbook was a challenge I posed to myself—to write more often, to write new stuff, and hopefully, to add value to my readers along the way.

I did write more. ~50,000 words (double of 2022), and ~5,500 were for The India Playbook.

I also experimented with new stuff. The India Playbook is data-heavy compared to Performonks. Ideas and data were swimming in my head, and I had to get them onto paper—the India Playbook helped me do that.

I ran a poll asking readers to vote if they wanted to read more of this. 54 readers responded. 50 of them (93%) voted in favour. That’s great. This also means more writing. We have to be careful about what we wish for!

So here’s what I want to do next.

Performonks will continue at its fortnightly cadence.

The India Playbook will be a separate section within the Performonks homepage on Substack - I will share quick, short examples of brands and business models building from a ‘category of one’ mindset. Occasionally, I may share long-form, deeply researched articles on one category or brand.

The India Playbook will evolve with your feedback and my energy. So please keep the feedback loops open!

You can read The India Playbook Archives here.

See you next time!