The India Playbook: One India, four markets

India contains multitudes and demands a fit-to-context playbook. I explore ten insights into the Indian market over ten emails. Part II: One India, four markets

Newsletter on ideas that help marketers do better and be better. Subscribe here.

Over the next few weeks, you will receive ten emails from me. Each mail will decode one insight about India and what it means for business.

Part II - One India, four markets

If in the previous edition, I gave you the impression that the Indian market is as difficult to pierce as the Chakravyuh, then what I’m going to tell you about Sting will give you hope.

Sting

While working on Lipton Ice Tea, I was also developing the launch plan for Sting Energy Drink. It was a relatively new brand at PepsiCo but was doing very well in Pakistan, Indonesia, and Bangladesh. Obviously, India wanted to see if we could replicate their success.

We were not disappointed. Sting was launched into the market in 2017 (much after I had moved on from PepsiCo). Within the first year itself, it outsold Lipton Ice Tea by at least 60x. Today, it’s the fastest-growing brand for PepsiCo India.

In the soft drinks industry, you know your brand is doing well when your competitor unabashedly copies it.

If you have any doubt about Sting’s success, take a look at Charged by Coca-Cola.

Why is Sting working so well? Is it the price? Lipton Ice Tea is Rs.25/- for 350ml. Sting is Rs.20 for 250ml. The gap is not large enough to warrant such a chasm in performance.

Indians, like all consumers, will buy only that which gives them value. Sting has Taurine and Caffeine which give an instant energy buzz. It does the job of affordable and socially sanctioned alcohol during the day (probably the reason it does so well in Pakistan, Bangladesh, and Indonesia). There is no real competition to Sting for this need.

On the other hand, Lipton Ice Tea is a cold tea-based beverage. An alien taste in a country where hot tea is like religion.

Like I said, the trick is to know what our consumers value.

Let me refine that. The trick is to know which India values what.

When we deaverage India, we realize that while this is one country, it is made up of four distinct firewalled markets.

The four Indias

India is like a vast mall with three floors and one penthouse. Each floor has a distinct consumer base and consumption capacity influenced by disposable income.

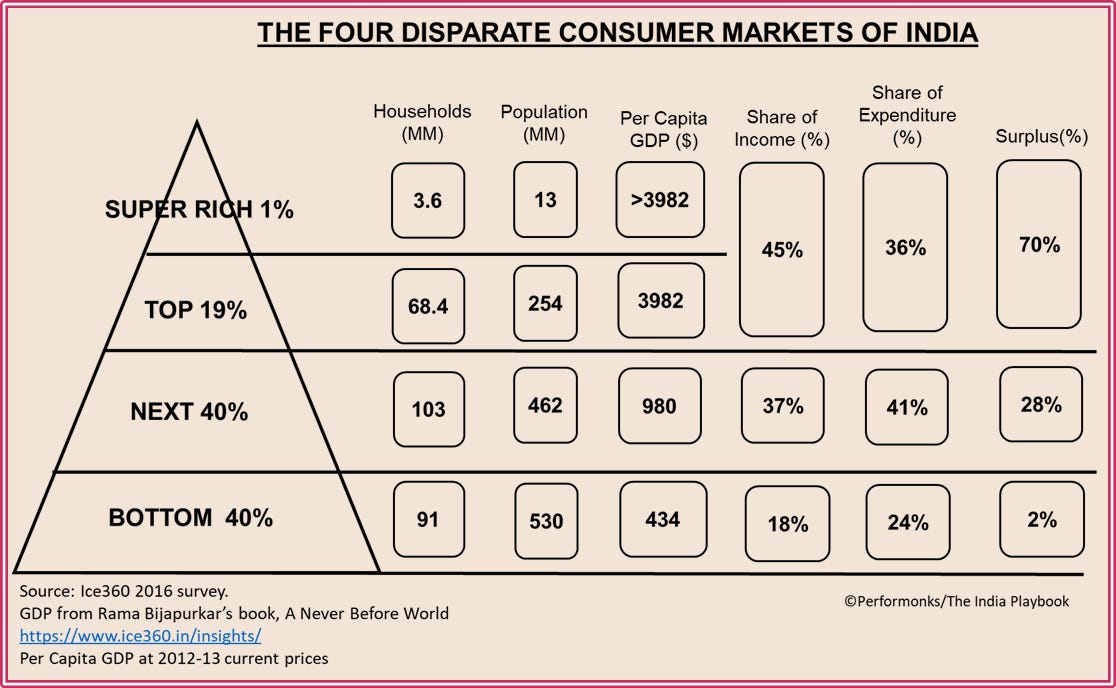

There are many different and often conflicting income projection sources for India.1 But I have taken Rama Bijapurkar’s robust analysis2.

Her analysis divides the Indian market into three tiers - Top 20%, Next 40%, and Bottom 40%. I have added a super-rich tier at the top @1% of households. The defining characteristic of each tier is disposable income. As we go down the pyramid, the sad reality is that households run on deficit - they have to borrow money (microfinance) frequently to make ends meet.

The penthouse and the third floor make up 1% and 19% of the market and form the ‘consuming class’. I call them the consuming class because out of 1.4 billion of us, only these 267 million earn more than what they need to spend on essentials - they earn 45% of India’s income and spend 36% of its expenses.

They own a staggering 70% of the surplus income that India as a whole has for discretionary purchases.

All markets have a rich consuming class. But what sets India apart are its large numbers. The penthouse floor houses 13 million Super Rich who have ‘Manhattan’ habits and are almost 10X of Manhattan (Manhattan’s population is 1.5 million). The Top 19% at 254 million are two-thirds of the USA and as big as Russia and the UK combined.

How the top 20% consume

The 1% (super-rich) have global habits: The super-rich could have organic green juice and Lox Bagel for breakfast and sushi for dinner if they want. Cheap labor and new-age startups have allowed these households to live cocooned in a lifestyle of comfort, convenience, and luxury that would cost them an arm and a leg in the West. Roads are potholed, and time is precious, so services come to their doorstep - fully equipped vans groom their pets or serve piping hot wood fire pizza.

The 19% are still educating themselves: This consumer has some money left over after paying for loans and other liabilities, but not so much that they can indulge. When we think of the top 19%, we automatically imagine a world of English-speaking jetsetters - CEOs, lawyers, teachers, and post-graduates.

In reality, people like Thayyal, whom we discussed in the last edition, belong to this segment. Thayyal’s earnings put her in this class, but she works as a house help and lives in a small house.

They have social media access, so they consume brand and lifestyle content which creates aspirations. But they stay away from risky adventurous choices and prefer only those new brands and products that enjoy social proof3.

So while they have happily adopted Chindian and Pizza, they have not yet made their way to Boba Tea and Japanese. At the same time, while they buy some new D2C brands, they only buy knockoffs of luxury brands like Louis Vitton and Manish Malhotra.

The balance 80% consumes a little bit at a time

The balance 80% of India lives paycheck to paycheck and bridges their expenditure-income gap each month through micro-loans. This is the segment that buys sachets, and prepaid data plans and frequents pawn shops.

The sheer scale of this population ensures that even the little bit they consume adds up to a market size of more than $1 trillion.

TL:DR

India is a single country but four distinct markets - each with its own brands, consumption baskets, and idiosyncrasies. While 80% of us consume a little bit over many shopping trips, only 20% have just enough disposable income to spare. But even they derisk their non-essential spending as much as possible.

This makes it difficult for any new brand to make quick inroads. The value equation, entry price, and social proof have to be designed for each of the four markets differently.

That’s why, the most critical first decision for businesses is “which India” they want to operate in.

Broad generalizations like, “Our target consumer is the Great Indian Middle Class” just muddy waters and raise unrealistic expectations.

Because in India, there is no middle class.

That’s for next time.

Thank you for reading!

Many different income projections. There is no commonly agreed data set of consumption segments and their income. There is a wide range of (often conflicting) data sets across BCG, Morgan Stanley, ICE360, and the World Economic Forum

When we analyze complex markets with imperfect data, we run the risk of getting lost in minutiae. That’s why I decided to power ahead and stick with two credible sources - Rama Bijapurkar’s Analysis with the experts at https://www.ice360.in/insights/.

And her book - A Never Before World. She is a respected researcher and scholar and has triangulated data from various government sources (NCCS, NSS, NSHIE), to develop this realistic analysis. (I highly recommend this book to all who wish to dive deeper into India).

Social proof reassures this segment that they are not running the risk of buying something that they won’t enjoy or won’t be able to use. If I want to spend my precious Rs.200 on eating out, I might try a Pizza for the first time if I see people around me also eating it and enjoying it!

So much to learn. Thanks Rashi. Teacher sounds old. Mentor i am not sure. But hindi they have a wonderful word पथप्रदर्शक. Thanks again.