Trilemmas have no one ideal solution

Trilemmas always involve trade-offs. When we prioritize two, we actively deprioritize the third.

In 2019, I signed up with ICF to learn how to be a coach. While I have still not completed the 100 hours of coaching practice to get my certificate, some coaching lessons have become innate to how I approach problem-solving.

Two key take-outs for me were:

First, identify the problem: the first 10-15 minutes of any coaching session are focused on identifying the problem. Oftentimes, we tie ourselves into knots and wrestle with different solutions without even identifying the real problem. But in reality, answers come to us easier once we know what we’re trying to solve in the first place.

Second, blend: many solutions involve either-or choices. We work ourselves into a tizzy trying to pick just one. But answers, like life, are not black or white. The most creative and impactful solutions come from blending.

For instance, I have wanted to write since 2005. After a failed attempt at starting a blog in 2005, I parked this dream in the ‘to-be-tackled-later’ basket. The real problem was not that I could not write. It was my self-limiting belief that a job and personal passion cannot coexist - that I was ‘cheating’ on my job If I wrote.

I had created an artificial dilemma in the form of an ‘either-or’ choice.

The solution was to blend job and writing. Once I started, neither compromised the other. On the contrary, writing about marketing helped clarify concepts I applied at work and my day job sparked off ideas I wrote about.

If we blend dilemmas, we can come up with win-win solutions. Try it, it works.

But Trilemmas? Like threesomes, they complicate matters.

Trilemmas always involve trade-offs. When we prioritize two, we actively deprioritize the third.

The impossible trinity

Trilemmas were first born in macroeconomics. The trinity of free-flowing capital, a flexible exchange rate and an independent monetary policy are impossible to balance for any country.

The policy trilemma, also known as the impossible or inconsistent trinity, says a country must choose between free capital mobility, exchange-rate management and monetary autonomy (the three corners of the triangle in the diagram). Only two of the three are possible. A country that wants to fix the value of its currency and have an interest-rate policy that is free from outside influence (side C of the triangle) cannot allow capital to flow freely across its borders. If the exchange rate is fixed but the country is open to cross-border capital flows, it cannot have an independent monetary policy (side A). And if a country chooses free capital mobility and wants monetary autonomy, it has to allow its currency to float (side B).

The Economist (source)

Exactly thirty years ago, Manmohan Singh, our then-finance minister, implemented economic reforms that catapulted India into economic growth. Very simply, he prioritized free capital mobility and monetary autonomy by devaluing our currency.

Thirty years later, the trilemma continues. To read more about it, check out these articles. Here, here and here.

I am not an economics expert, so let’s move quickly onto three famous business trilemmas.

In this edition, I explore:

Price-Quality-Time

Innovation-Profit-Market Share

Selection-Speed-Price

In the next edition, I will look at personal trilemmas.

Trilemma #1 Price-Quality-Time. Solution: Develop a portfolio.

This trilemma follows us everywhere. Whether we are getting our house painted, making an advertisement, or hiring house help.

A fast-tracked delivery at a lower cost always compromises quality.

On the other hand, exceptional quality is well deserving of the price but is often delivered too late. (A situation we face often with A-class directors when we make our brand films).

The solution is to develop a portfolio: We can develop a portfolio of expectations. For instance, we compromise quality in favour of speed for a tactical consumer promotion film. But we are willing to wait for the best quality director in case of a strategic thematic film.

Equally, the advertising agency responds by developing a portfolio of delivery. Their best talent prioritizes the most high-quality projects over business as usual.

Trilemma #2 Innovation-Profit-Market Share. Case study: Samsung vs Apple

Apple, Samsung, Huawei, Xiaomi, Lenovo, Oppo, VIVO… all compete aggressively in the global mobile phone market.

A high market share means affordable products are sold at scale - the more mass a product, the less innovative it is. On the other hand, a highly innovative product will be expensive and will be purchased by a small niche of early adopters, resulting in a low market share. While profit can be generated in both high and low market share scenarios.

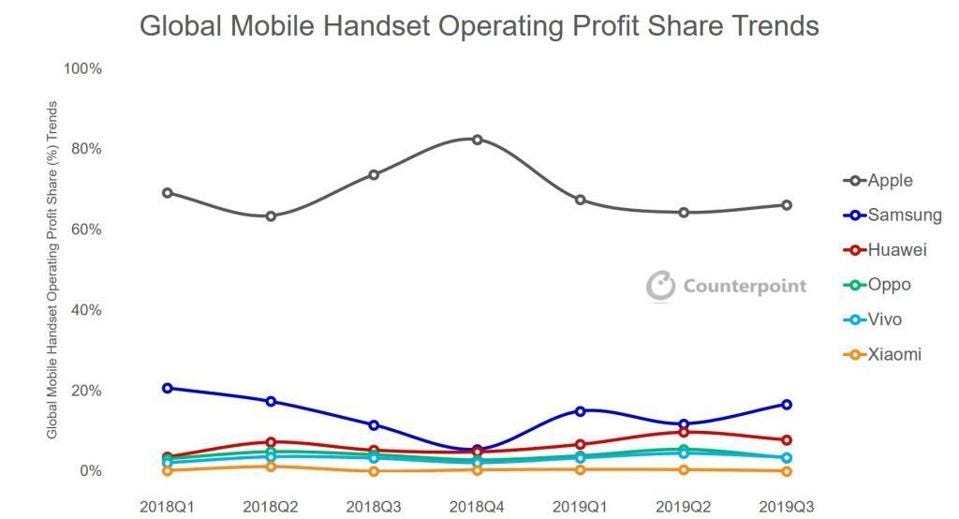

Apple and Samsung solve this trilemma very differently. Samsung has balanced the trilemma by optimizing for dominant market share alone, with muted profitability and innovation. While Apple has deprioritized market share dominance and optimized for innovativeness and profitability.

Here is how.

Market share: market leadership despite the nutcracker effect (Samsung)

Apple is the first mover, while Samsung is the fast follower. Samsung faces a nutcracker effect where it gets squeezed from the top by premium phones like Apple and from the bottom by more affordable phones.

So it innovates new products both at the top end and the mass end of the market. And it ‘buys’ market share by investing heavily in marketing. This flanker strategy, coupled with marketing gives it a dominant share. But reduces its profits.

The chart below shows Samsung’s market dominance, followed by Apple at No.2.

Innovation: most innovative (Apple), fast follower (Samsung)

Apple is the first mover and has the most innovative products with a loyal base that keeps upgrading along with each new iPhone version. Even though it follows Samsung in market share, it is the most innovative company globally.

Profit: low-cost production and scale premium products (Apple), high marketing spends (Samsung)

Apple is far more profitable than Samsung because they manufacture premium products at low costs due to global scale and strong logistics strengths.

Both are winning

Apple has prioritized innovativeness and profitability. Samsung dominates in market share for moderate profitability (due to high marketing investments) and has settled for the follower spot on innovation.

Trilemma #3 Selection-Speed-Price. Case study: Walmart vs Amazon

Every consumer wants the widest product selection, delivered as quickly as possible for the best price. Retailers can only satisfy two out of three and still remain profitable.

This trilemma plays out well in a developed market. In the US market, Amazon and Walmart approach the trilemma differently.

Speed: now (Amazon) versus on the way home (Walmart)

Amazon prioritizes speed via the one-hour delivery for Prime members. They have spent millions of dollars to create a local distribution network. In 2017, the company spent $21.7 billion on shipping alone. In Q4 2019, it spent $1.5 billion only on one-day delivery. [source: retailtouchpoints.com]. During the pandemic, Amazon has increased capital expenses by 80% to invest in logistics and data centres.

Walmart does not go head to head with Amazon on one-hour delivery. Instead, it offers free same-day in-store pickup for in-stock retail items. Consumers prefer it because visiting Walmart is already a habit. They don’t mind stopping by at a nearby Walmart and combining it with other errands/last-minute shopping.

Price: prime membership (Amazon) versus lower cost (Walmart)

Free in-store pick-up does not put a dent in Walmart’s profits because it anyway ships bulk orders to stores. Walmart passes on this price advantage to consumers. Meanwhile, Amazon Prime consumers pay $119 annual membership fees.

Product selection: nearly everything (Amazon) versus enough for most shoppers (Walmart)

In 2017, Amazon offered an estimated 375 million products, while Walmart offered 23.5 million. It is not cost-effective for Walmart to stock millions of SKUs, and it focuses on items most shoppers want more frequently.

Both are winning

Neither retailer has mastered all three challenges. But they satisfy their consumers by solving two out of three. For Walmart, it’s pace and price. For Amazon it’s product selection and pace. Each approach appeals to different consumer groups.

Amazon has a better value proposition for higher-income customers who want convenience and variety and will pay for it. Walmart has a better value proposition for customers with lower incomes who want quick pick-up and the lowest possible prices.

It depends

The beauty of trilemmas is that all answers are right. Whichever answer we pick depends on our context, our risk appetite and our ‘why’.

After that, success depends on committing and executing with excellence.

What business trilemma are you grappling with right now?