Lemonade - a zone of mastery business

Disrupting anything is tough, but disrupting the insurance industry? Sacrilegious. Lemonade has done this brilliantly

Practical ideas on marketing strategy and self-mastery they don’t teach in B-school. If you like it, join the tribe here.

As someone whose default thought process is to challenge the status quo, my antennae are sensitized to disruptive ideas. I am also a huuuuge fan of behavioural economics.

So when I learned how Lemonade is using behavioural economics to challenge 125-year-old insurance behemoths, I had to write about it.

The insurance industry does not run on love and fresh air, any more than cars run on coffee. In fact, big insurance companies are incentivized to deny claims.

This is how the business model works at a high level. We pay monthly premiums in return for a promise by the insurance company that we can claim losses we may incur from adversity. Insurance companies pool all premiums to pay off future claims. Since the insurance company does not want this money to stay idle, it invests it.

But we know that only a small percentage of us end up filing a claim. This gives insurance companies huge financial leverage, and they continue to grow wealthy as their investments compound.

In fact, Warren Buffet started building his wealth via insurance. He believes this asset class is bulletproof and prefers it over other asset classes. Here is a newspaper article he wrote 20 years ago.

So, the business model incentivizes Insurance giants to deny claims on one hand and reduce operating costs by favouring high-value items like houses, cars, etc., over low-value items like pets and bikes.

This has created a combative and mistrustful relationship between big insurance and consumers.

Lemonade does the opposite. They do not earn from investing unpaid premiums. Instead, they keep costs low and earn a flat fee on each insurance policy. This keeps their business model clean. So they insure even low-value items and pay out claims within minutes.

They have been so successful with this new model that they have served 1mio customers in 5 years, with ~$1bio revenue.

To do this, they broke every rule in the centuries-old playbook.

Target audience: Serving future consumers, alienating everyone else

Experience: Tech-enabled service replacing insurance agents

Social Good: Converting necessary evil to social good

Low-cost marketing: Marketing that makes insurance ‘cool’

Serving future consumers, alienating everyone else

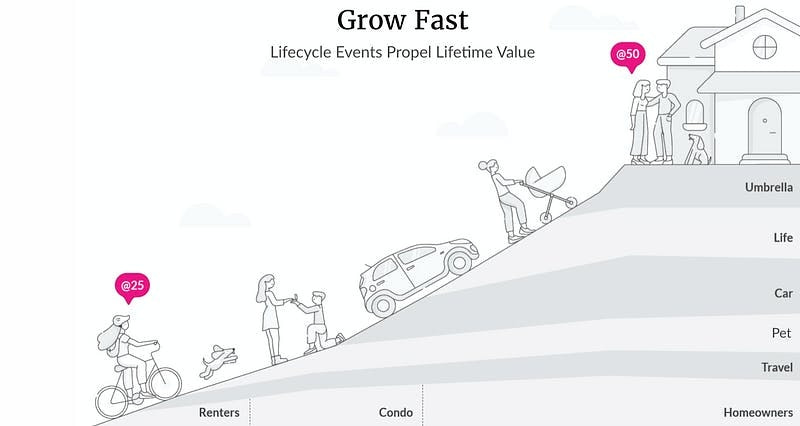

Big insurance does not insure low-value products, so it doesn’t talk to Millennials. But most of Lemonade’s consumers are under 35 and first-time insurance buyers of home rentals and pets, with premiums as low as $60.

For Lemonade, millennials are less of a demographic but more of an attitude—people who embrace the transformative power of technology. Lemonade is so sharply focused on this audience that it purposely alienates the traditional insurance buyer.

This is also a future-ready business because today’s millennials are tomorrow’s high-net-worth insurance buyers.

Tech-enabled service replacing insurance agents

Big insurance is an analog world. The user experience involves agents and reams of complex paperwork and hassle. Lemonade is an InsureTech company, therefore it is Direct to Consumer. It uses bots and tech algorithms to process policies within 3 seconds to 24 hours!

Quick Claim Settlement

Unlike big insurance, claims are processed hassle-free. Pictures and videos of damages can be uploaded directly on the app, and claims are sent directly to debit cards within seconds.

No complex legalese

They have also crowdsourced (!) the policy document and made it simple, free of opaque legalese, and more human.

Here is a video that explains the end-to-end process.

Converting necessary evil to social good

Social good is important to millennials. While big insurance is seen as a necessary evil, Lemonade bakes social good right into its business model.

Lemonade earns a flat fee of 25% per cover, so it has no incentive to deny claims. Any unclaimed premium is donated to charities picked by consumers. Lemonade’s consumers know that if they make fraudulent claims, the money is taken from their chosen charity, not Lemonade.

This visual shows the Lemonade business model.

This virtuous circle fosters trustful relationships between the insured and the insurer.

Lemonade Givebacks have only grown in the last few years.

The insurance industry is built on a foundation of mistrust. The highest NPS score any big insurer gets is ~20. Lemonade has an NPS rating of 70.

Marketing that makes insurance ‘cool’

The industry invests a lot of money in human interaction to make the sale. Lemonade's challenge was to win trust as a faceless App, but they ended up doing more than that.

They made insurance cool.

The Name

Who in their right mind names an insurance company “Lemonade”? Doesn’t it sound juvenile? Incompetent? They took the risk. And it worked. For one, it signalled the difference between them and big insurers. It appealed to millennials who shy away from self-important behemoths.

But the name alone would not have worked if not for the simple, transparent, and even vulnerable marketing tone and manner.

Vulnerability

To be vulnerable is to be human. Lemonade was transparent from day one. They publish performance numbers freely, share multiple examples of negative feedback, and even a blog post saying, We suck, sometimes. What insurance brand would admit that “our underwriting was pretty shoddy in our early days”?

Lemonade’s communication style mirrors the easy, breezy product experience and supports the picture of a trustworthy, transparent, humane brand. They even discuss internal restructuring and KPIs openly on their blog. As a customer, feeling like a part of the Lemonade community is easy.

Visually stunning social media

This Instagram feed does not look like it belongs to an insurance player. Their signature magenta colour scheme adds colour to a drab industry, and their content adds a quirk that appeals to millennials.

I have covered how Lemonade went about its social media strategy here.

Cheaper Marketing

Extravagant marketing in a low-trust industry sends the wrong signal - of pockets lined with consumer dollars. Big insurers spend billions of dollars on marketing. Lemonade spends billions less. They spent only $57.9 million in 2020.

TL:DR

This is the Lemonade playbook summarized. Read bottom up to see the industry fundamentals that Lemonade overturned:

There are no holy cows. Insurance has been successful for centuries. But longevity does not guarantee future success. Here are my learnings:

Don’t disrupt for the sake of disruption. Lemonade is not a bull in a china shop. Each element of disruption emanated from deep consumer knowledge of tech-savvy millennials and complete conviction that old insurance is broken and needs to be fixed.

Disrupt completely. Once the logic to disrupt is in place, don’t be half-hearted about it. Go all the way. Every part of a company is interrelated, and a change in one function has a knockdown effect across the entire organization. Lemonade stayed true to the disruption gene across all functions.

Deep homework makes it look easy. Lemonade has worked so hard to perfect the consumer experience that it makes it look effortless. For instance, they have data-heavy algorithms [rental rates, safe neighbourhoods, market movements, etc.] in the background so they can generate a premium calculation within seconds.

Secret Sauce. Behavioral economics is the new consumer insights function. Renowned behavioral economist Dan Ariely advises Lemonade. Every element is designed to win trust and be humane.

This, my friends, is a perfect example of a Zone of Mastery business.

That’s all for today…

Stay inspired!