Newsletter on ideas that help marketers do better and be better. Subscribe here. Check out my new website here.

Monsoon time. Seasons are changing again. We are racing towards the end of yet another year.

2023 has been a momentous year for me - starting a new career, unlearning the old even as I decide the new stuff I want to learn.

But most of all, I'm trying to pause. And failing.

I feel like I am suspended between the past and the future. Yet, I am not still living in the now. Sorry, Eckhart Tolle.

That’s why this is a slightly philosophical edition.

We tend to think about our present-day reality at a moment in time and in the form of averages. This traps us into three illusions about the world and our place in it.

The probabilistic world and the hindsight bias

The tyranny of the normal distribution curve and the Just World belief

The overnight success bias

1. The probabilistic world and the hindsight bias

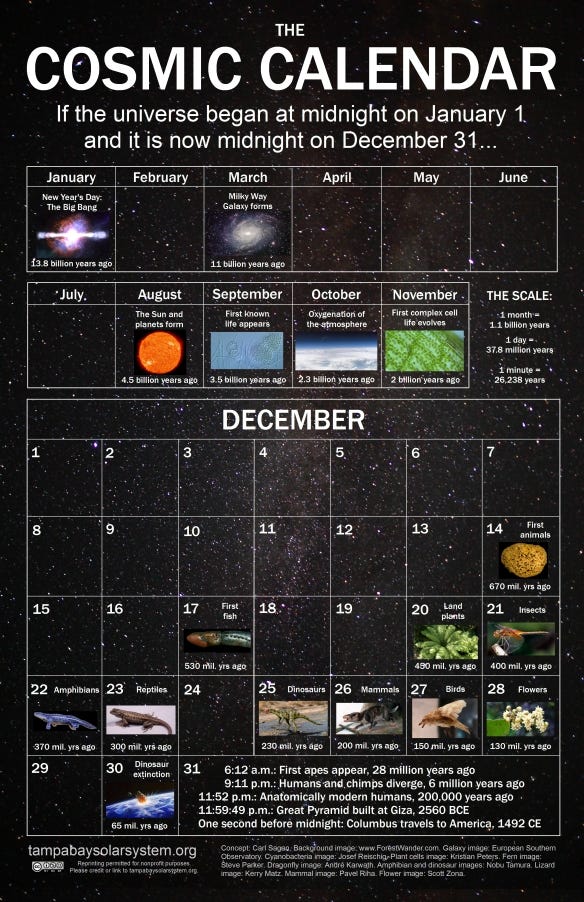

If we compress the entire cosmic timeline, starting with the Big Bang, into one calendar year, we come to the shocking realization that humankind is in its infancy.

We evolved from apes as late as 11:52 PM - just 8 minutes before the end of the year!

Once we get over this shock, we realize that the universe (as we know it) would not have existed but for a precise sequence of events that unfolded over 13.8 billion years. Chemistry, biology, and physics laws are delicately balanced to make our Solar System just so.

There are many counterfactuals to this sequence of events. Had the asteroid that killed off all the Dinosaurs hit the earth a millisecond later, or a millisecond earlier, we might not have existed. If two hydrogen and one oxygen atom were not fused, today, earth might be a dry wasteland. Had Chimpanzees evolved differently, today homo sapiens might have been in cages, eating bananas and flinging feces at each other.

A mere millisecond of deviance in the copulation habits of our parents and you and I might have been different genders… who am I kidding, you and I would not even have existed.

We don’t acknowledge that all of this is based on probabilities. Instead, we go through our lives believing that things are predetermined - they happened precisely how they were intended to. This is hindsight bias.

This deludes us into the illusion that we have full control over our uncertain world.

This also leads us to cherry-pick those probabilities that ‘suit’ us.

To paraphrase Nassim Taleb,

Is it possible to lose all your hair in one day? Only if you shave it all off.

Is it possible to lose all your money in one day? Yes.

Yet, we underplay the probability that we might lose all our wealth in one stock market crash. Let’s say there’s a 77% chance of profit for a financial investment. Our brain lazily equates the 77% chance of success to 100%. When, in fact, there is a 23% probability of a negative outcome. We cannot ignore these odds of failure. But we do.

Maybe underestimating the unexpected keeps us from becoming nervous wrecks. Yes, it’s unlikely that Zoom will crash on the day of your big presentation. It’s unlikely that the person who was supposed to evaluate your presentation gets sick. It’s also unlikely that you spill coffee over your laptop right before the presentation. But add up all these unlikely events, and it becomes relatively likely that something unexpected might happen.

Experienced presenters don’t worry. They prepare. They might prepare a joke for when things go wrong. They may have backups and printouts and also record the presentation beforehand.

The same logic applies to all the good things that could happen to us. Only once we accept that the unexpected happens all the time can we also open ourselves up to both downsides and upsides and stay ready for anything.

Take the example of Nathaniel Whittemore. In April 2020, he was stranded unexpectedly in London because of the ash cloud from an Icelandic volcano eruption. Whittemore realized that he was not the only social entrepreneur twiddling his thumbs in London after attending the Skoll World Forum on Social Entrepreneurship. Within 36 hours, Whittemore had organized the TEDxVolcano conference, with 200 attendees, world-class speakers, including eBay’s first president Jeff Skoll, and a livestream watched by 10,000 people.

Life is nothing but a series of probabilities. Matt Haig says it best in The Midnight Library.

“At the beginning of a game, there are no variations. There is only one way to set up a board. There are nine million variations after the first six moves. And after eight moves there are two hundred and eighty-eight billion different positions. And those possibilities keep growing. In chess, as in life, possibility is the basis of everything. Every hope, every dream, every regret, every moment of living.”

This brings us to the second illusion.

2. The tyranny of the normal distribution curve and Just World belief

We believe we live in a Just World.

This makes us think that even though sometimes we’re up and sometimes we’re down, in the end, everything averages out.

That’s why, we believe our life outcomes will fall along a normal distribution curve like the one below.

We tell ourselves that we are happy to not be the hyper achievers at the extreme right, nor are we the total losers at the extreme left. We are “normal”, maybe even above average and that keeps us happy with the status quo.

Reality is, sadly, very different.

Life resembles the power-law distribution curve - the "long tail.” Long tails skew outcomes for us much more than we allow ourselves to believe. One or two crucible events will set us up for a huge success, or one or two great misfortunes will threaten everything we have worked for.

“Long tails – the farthest ends of a distribution of outcomes – have tremendous influence in finance, where a small number of events can account for the majority of outcomes.” —Morgan Housel

In the Psychology of Money, Morgan Housel says when it comes to investment decisions, 99% of the days don’t matter. Instead, the decisions we make on the few days when something big is happening – a massive stock market fall, a bubble, or a frothy market – make all the difference.

Warren Buffet has owned 400 to 500 stocks during his life. But he’s made the majority of his money on 10 of them.

Bill Gates used to say that there were a handful of people at Microsoft who "made" the company, and if they left, there would be no Microsoft.

We need to be wary of averages because averages hide the extremes.

Making decisions based on averages is like using tarot cards for business strategy.

In situations where luck plays a role - investments, career progression, marketing, and business - power laws apply, and rewards do not follow a normal distribution.

The only thing that rescues us from probabilistic life outcomes and the power law is consistency and compounding. 1% daily improvements even in small sums of money, middling careers, and good enough relationships compound over time and leave us much better off than where we started.

Warren Buffet made 99% of his money after he was 52. All through compounding. And because he did not meddle with what he knew was a good thing.

That’s why there is no overnight success - our third illusion.

3. The overnight success bias

At the time of writing this, Google search threw out 21 million results for ‘Luckygirl syndrome” - the latest social media trend that’s doing the rounds.

It seems to be nothing but manifestation techniques from The Secret, packaged in a new bottle.

Our society is obsessed with stories of seemingly instant success and stardom. Instagram is full of hacks like the one below that make it seem like earning money is child’s play.

Somehow, if we believe the myth that success happens quickly and easily, our journey becomes easier.

We forget that in reality, most success stories have years of grit, sweat, and perseverance behind them.

I’m sure you know these stories.

The Beatles performed live in Hamburg for two years, sometimes for eight hours every night, before finding fame.

Michael Jordan was cut from his high school basketball team and had to train for years before breaking into the NBA.

J.K. Rowling’s first Harry Potter book was rejected by 12 publishers before it was published.

Again, navigating all three illusions seems to boil down to compounding our efforts and yet knowing that outcomes are not in our hands.

You know what makes it easy? Remembering that our brain is like putty. By changing our focus, by changing what we see, hear, and think. We can change our perspective completely.

Don’t believe me? See in the video how just the power of suggestion changes what you hear.

Until next time!